Australia's housing system needs a big shake-up: here's how we can crack this

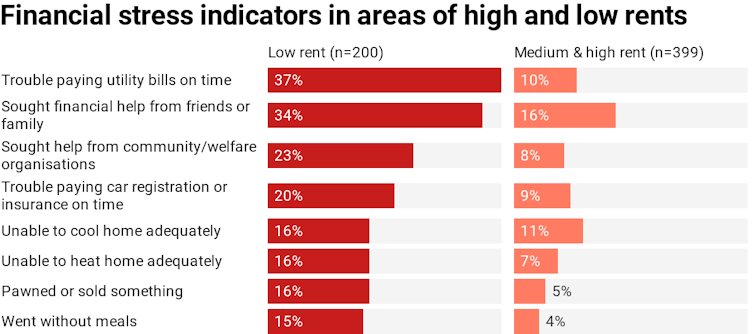

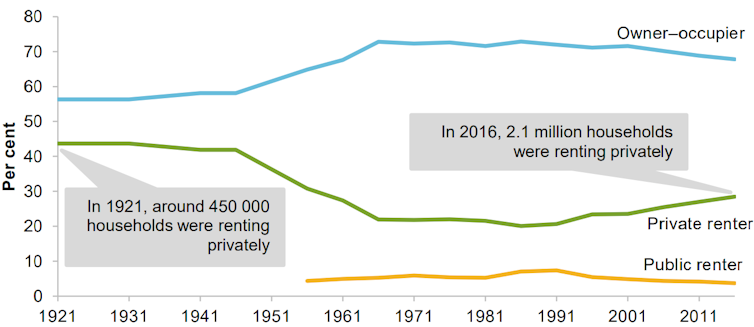

Millions of Australians are struggling with unaffordable housing. It’s a systemic problem that’s been decades in the making, and only concerted system-wide reforms will fix it.