Actuarial, Finance, Risk and Insurance Congress

About AFRIC

AFRIC has been designed to be a premier non-profit making Actuarial Science academic conference that will be rotationally hosted across Africa, bringing together academics and practitioners with research interests across all specialty areas of actuarial science, risk management, and financial system regulation. AFRIC aims to enhance the research culture within Africa's actuarial community. Hence, key topical areas including climate extremes, longevity risk, pensions, and insurance regulations, among others, form part of the AFRIC agenda. AFRIC will bring talent to a talented audience with massive potential of impacting their respective countries and societies. AFRIC is partnering with various universities across Africa and around the globe, actuarial societies, insurance regulators, and financial institutions. Pre-conference workshops will be run at each AFRIC gathering to provide hands-on skills for tackling critical challenges in today’s world.

-

- Stochastic models in life and non-life insurance

- Pensions, financial system and insurance regulation

- Application of data analytics and machine learning to actuarial science

- Artificial Intelligence in actuarial applications

- Peer to peer insurance arrangement

- Mortality modelling

- Financial mathematics

- Financial Institution and insurance risk management

- Health economics and insurance

- Longevity risk and retirement planning

- Optimal control

- Reinsurance

- Asset-liability management

- Climate extreme

- Application of actuarial techniques in banking

Plenary Speakers

Dr. Blessing Mudavanhu

Dr Mudavanhu is the Group CEO and Executive Director of CBZ Holdings. He has many years of experience in the regional and international financial services markets and he brings with him a wealth of knowledge and experience in risk management. He is also a non-Executive Director at the Development Bank of Southern Africa (DBSA). Dr Mudavanhu received his Doctorate in Mathematics from the University of Washington (USA) and a Masters degree in Financial Engineering from the University of California at Berkeley (USA). Upon completion of his studies, he joined American International Group (AIG) in New York as a Senior Risk Analytics Associate. Following his time at AIG, Blessing joined Bank of America Merrill Lynch as Director in Global Risk Management encompassing New York City, London, Mexico City and Sao Paulo.

In 2010 he joined African Banking Corporation (BancABC) as Group Chief Risk Officer and served as Acting Group Chief Executive Officer for 2 years. BancABC had operations in Botswana, Mozambique, Tanzania, Zambia, Zimbabwe and a minority interest in a large Nigerian Bank. He left BancABC in January 2017 to set up Dura Capital LLC in Johannesburg. Dr Mudavanhu was Adjunct Professor of Risk Management in the Financial Mathematics Program at Baruch College of The City University of New York. He currently is a Visiting Senior Lecturer in the School of Computer Science and Applied Mathematics as well as a Sessional Lecturer at Wits Business School at the University of The Witwatersrand in Johannesburg.

Professor Corina Constantinescu

Corina Constantinescu is Professor of Mathematics and Director of the Institute for Financial and Actuarial Mathematics, in the Department of Mathematical Sciences, at the University of Liverpool, UK. Prior to being an academic, Corina worked as an actuary and led the life insurance department of one of the first private Romanian insurance companies. Since 2013, together with Professor Severine Arnold of HEC Lausanne, they have been organizing the PARTY conferences for young researchers. During 2013-2016 she coordinated the RARE network, within a four-year EU Framework 7 project, connecting 12 international institutions of great repute, to work on the theoretical side of the analysis of ruin probabilities in case of disasters or extreme shocks for insurance-like risk pools, by the introduction and analysis of new risk measures, and by (asymptotic) quantification of aggregated risk. Since 2018, she is regularly teaching and supervising MSc students from the African Institute of Mathematical Science (AIMS) network. In 2020, she was one of the two academics named on the 100 Women to Watch list of the Cranfield University’s School of Management, as ideally suited to board positions on FTSE 350 companies. Given her practical perspective, many of her papers are published in actuarial journals, however she also publishes in applied probability journals. She serves as associate editor in a number of actuarial journals and is part of the publicity team of Bernoulli Society for Mathematical Statistics and Probability. Her expertise is in analytical methods for deriving exact or asymptotic results for ruin probabilities, with light or heavy-tailed assumptions in complex insurance risk models. Some of her more recent research interests are around fair insurance pricing when gender is not considered a factor, as well as financial inclusion, specifically fair pricing and regulation of microfinance and microinsurance practices. She spends her sabbatical year, 2022-23, as visiting scholar within the Social Finance Programme of the International Labour Organization - the United Nations agency for the world of work.

Ms. Marjorie Ngwenya

Marjorie serves an independent non-executive director in the financial services sector. She is also a trustee of two social justice non-for-profit organisations active in Southern Africa. In 2022, she was appointed as an external member of the Prudential Regulation Committee of the Bank of England. Marjorie is a regular keynote speaker on topics such as ‘Purpose and Meaning: the Keys to Life’ and the Unlimited Power of Your Potential’. Through her work as a leadership and life coach she demonstrates her passion for personal growth. She is also an advocate for diversity, equity and inclusion. She is a Past President of the Institute and Faculty of Actuaries (IFoA) and was the first person of colour to hold office in the organisation’s 160 years and also its youngest. Her prior roles include being a member of the Group Executive Committee of Liberty Group in South Africa, playing the role of Chief Strategist and Chief Risk Officer of Old Mutual’s African Operations. Marjorie trained as an actuary and holds a Sloan Master of Leadership and Strategy from the London Business School.

Professor Moshe Arye Milevsky

Moshe Arye Milevsky is a tenured professor, published author and consultant based in Toronto, Canada. He has an M.A. (1992) in Mathematical Statistics, a Ph.D. (1996) in financial economics, and he is a (2002) Fellow of the Fields Institute for Research in Mathematical Sciences. Most recently (2022) he earned an MSc from the Department of History, Classics and Archeology at the University of Edinburgh, Scotland.

He is a world recognized expert on the financial history and economic design of “retirement products” that help consumers manage longevity risk towards the end of the human life-cycle.

Dr. Milevsky has published 17 books (translated into 6 languages) and has authored over seventy peer-reviewed scholarly articles. His book: King William’s Tontine: Why the Retirement Annuity of the Future Should Resemble Its Past (Cambridge University Press) was granted the Kulp-Wright Book Award from the American Risk and Insurance Association. And, his latest book How to Build a Modern Tontine: Scripts, Tips and Algorithms was published in the summer of 2022.

Professor Mary Hardy

Mary Hardy is a Professor of Actuarial Science at the University of Waterloo in Canada. Her research focuses on actuarial risk management, particularly in the context of equity-linked life insurance, and employer sponsored pension plans. Her current research focuses on social impacts of actuarial stewardship. She has written three books and around 80 papers on a range of topics in actuarial and quantitative risk management.

Dr Hardy earned her PhD at Heriot-Watt University, where her supervisor was Dr Howard Waters. She is a Fellow of the Institute and Faculty of Actuaries, a Fellow of the Society of Actuaries, and a Chartered Enterprise Risk Analyst.

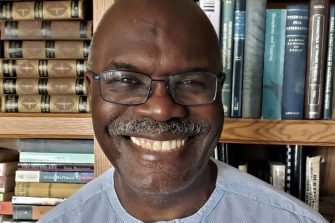

Mr. John Robinson

John W. Robinson, FSA, MAAA, FCA (2022-2023)

President and Chair, Society of Actuaries

Robinson recently retired as an actuary with the Minnesota Department of Commerce, where he was responsible for reviewing the actuarial components of the annual statements of the life insurance companies domiciled in Minnesota, and for providing actuarial support in the reviews of life insurance and annuity product filings. He also represented Minnesota on various committees with the National Association of Insurance Commissioners (NAIC). His prior actuarial roles were in OPEB valuations, life insurance, and pensions.

Robinson previously served as a member of the SOA Board of Directors. He volunteers regularly as an SOA exam grader and with the SOA’s Diversity, Equity and Inclusion Committee, and the Diversity, Equity and Inclusion Research Advisory Committee. Robinson previously served as president of the International Association of Black Actuaries (IABA). He holds a B.Sc. (Special) in Mathematics from the University of the West Indies, Jamaica, an M.S. in Statistics from the University of Delaware, and an M.S. in Statistics from Florida State University.

Professor Roseanne Harris

Roseanne is Health Policy Actuary at Discovery Health and also adjunct professor in the School of Statistics and Actuarial Science at the University of the Witwatersrand, Johannesburg. She was President of the Actuarial Society of South Africa in 2016/17 and President of the International Actuarial Association in 2022. She is currently chairing the IAA Strategic Planning Committee in her role as immediate past president and also serves on the education committee. Roseanne’s areas of practice have been healthcare and employee benefits as well as education. She also has a keen interest in promoting diversity in the actuarial profession and supporting public interest initiatives.

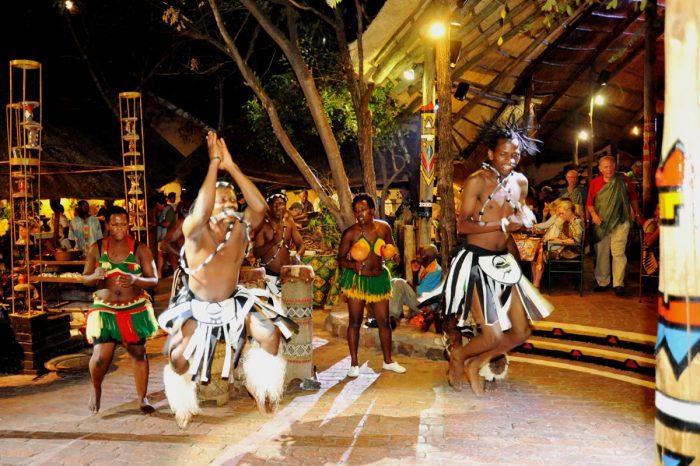

Gallery

Conference days

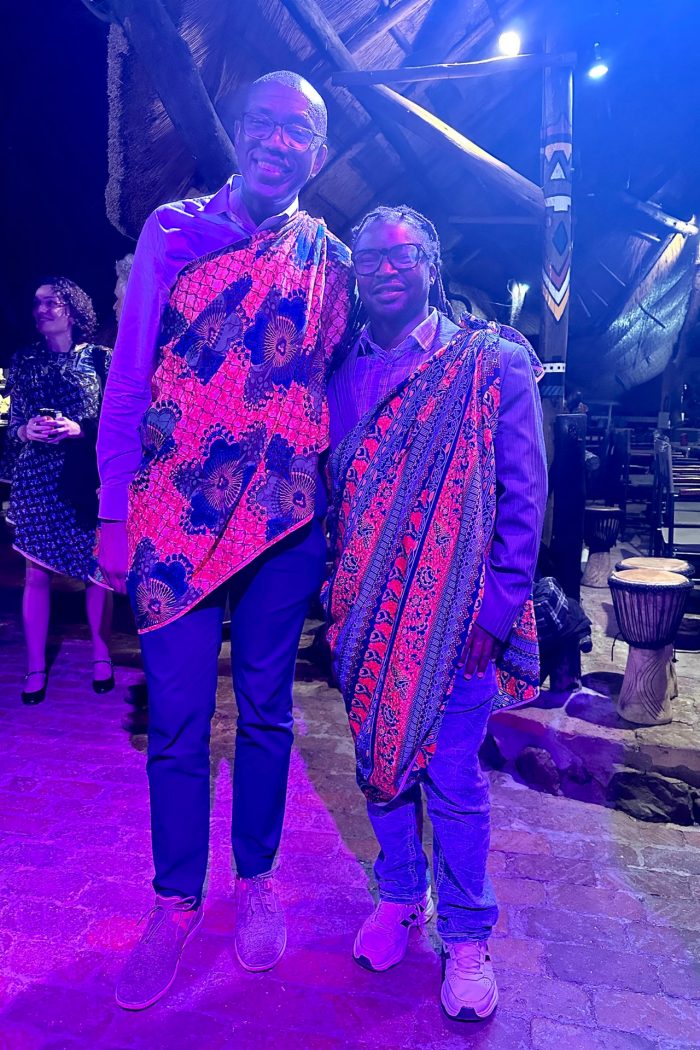

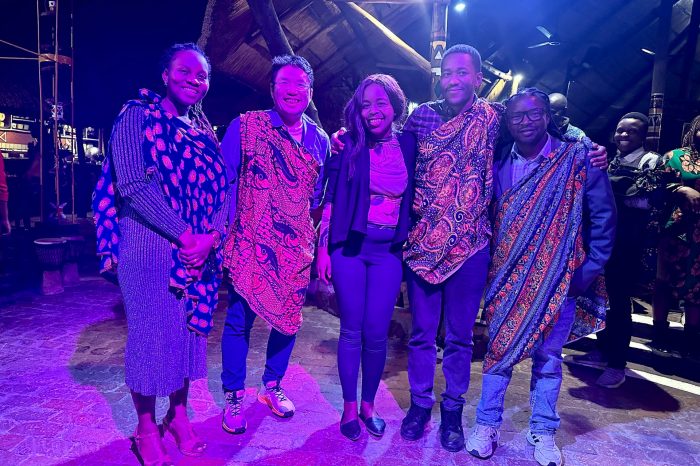

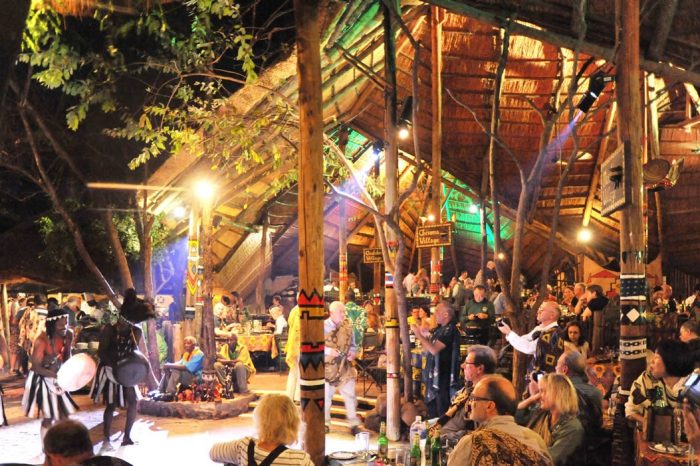

Social

Program Overview and Abstracts

- Monday, 24 July

- Tuesday, 25 July

- Wednesday, 26 July

- Thursday, 27 July

- Friday, 28 July

| Time | Session Details |

|---|---|

| 08:00-08:30 | Registration |

08:30 - 08:45 |

Official Opening & Welcome Remarks & Housekeeping

|

08:45 - 09:10 |

Plenary Session Guest of Honour Address Professor Chris Styles, Dean, UNSW Business School, UNSW Sydney and Professor F Mangena, Dean, Faculty of Arts and Humanities, University of Zimbabwe Chair: Jerry Parwada

|

09:10 - 10:30 |

Panel Discussion: Digitalisation & Technology Chair: Michelle Mangwanya and Jason Pereira

|

| 10:30 - 11:00 |

Society of Actuaries Sponsored Coffee Break

|

| 11:00 - 11:45 |

Plenary Session: Mary Hardy - Fairness in Insurance Pricing Chair: Bernard Wong

|

| 11:45 - 13:00 |

Data Analytics Workshop Facilitators: Andres Villegas, Chessman Wekwete and Ronald Richman

|

| 13:00 - 14:00 |

Lunch

|

| 14:00 - 16:20 |

Data Analytics Workshop

|

| 16:20 - 16:30 |

CAS Sponsored Coffee Break

|

16:30 - 18:00 |

Data Analytics Workshop Facilitators: Andres Villegas, Chessman Wekwete and Ronald Richman

|

| Time | Session Details |

|---|---|

08:30 - 09:10 |

Plenary Session - Marjorie Ngwenya Public Interest Issues & professionalism Chair: Kristina Sendova

|

09:10 - 10:30 |

Contributed Talk Parallel Session 1.1 Risk Modelling Chair: Jan Dhaene Location: Room 1 09:10 Jed Frees - Algorithmic Commercial Risk Retention 09:30 Fangda Liu - Model uncertainty and applications in insurance design 09:50 Ruodu Wang - Some recent results on the axiomatic theory of risk measures 10:10 Titus Rotich – Microsimulation Modelling for Malaria Cost Estimations in Kenya

Contributed Talk Parallel Session 1.2 Banking and Finance Chair: Elvira Sojli Location: Room 2 09:10 Patricia Lindelwa Makoni - Revisiting the ODA-FDI nexus in developing African countries 09:30 Ndava Constance Mupondo - GDP growth and Stock Market volatility spillovers between Zimbabwe and the United States of America, South Africa, Botswana and China

Contributed Talk Parallel Session 1.3 Chair: Clemence Chimwanda Location: Room 3 09:10 Munir Hiabu - On functional decompositions, post-hoc machine learning explanations and fairness 09:30 Salvatory Kessy - Averaging mortality rates from multiple starting points 09:40 Fahad Javed Malik - Addressing the availability and affordability crisis of home insurance in flood-prone areas of Australia

|

10:30 - 11:00 |

Society of Actuaries Sponsored Coffee Break

|

| 11:00 - 12:20 |

Panel Discussion: on Inclusive Insurance/Micro-insurance Chair: Lynette Tasaranarwo Title: "Success Stories of Inclusive Insurance Initiatives in Africa and their Impact on the Insurance Market"

|

| 12:20 - 13:00 |

Plenary Session: Corina Constantinescu Chair: Daniel Linders

|

| 13:00 - 14:00 |

Lunch

|

| 14:00 - 15:20 |

Contributed Talk Parallel Session 2.1 - P2P Risk Sharing Chair: Laura González-Vila Puchades Location: Room 1 14:00 Daniel Linders - The P2P pandemic swap: decentralized pandemic-linked securities 14:20 Peter Bhibhi - Assessing the perception of farmers towards Peer-to-Peer insurance scheme 14:40 Hamza Hanbali - Mean-variance longevity risk-sharing for annuity contracts 15:00 Jan Dhaene - An axiomatic theory for comonotonicity-based risk sharing

Contributed Talk Parallel Session 2.2 - Derivative Pricing Chair: Doreen Kabuche Location: Room 2 14:00 Claude Moutsinga - A time multidomain spectral method for valuing affine stochastic volatility and jump diffusion models 14:20 Yoboua Angoua - Determinants of insurance uptake in sub-Saharan developing countries: evidence from Cote d’ivoire 14:40 Xavier Milhaud - Two-sample contamination model test 15:00 Elaine Collins – Systemic Risk Pools

Contributed Talk Parallel Session 2.3 - Mortality Modelling and Health Risks Chair: Diana Skrzydlo Location: Room 3 14:00 Andres Villegas - Estimating and modelling mortality rates in the absence of population denominators

|

| 16:20 - 16:30 | CAS Sponsored Coffee Break |

| 16:30 - 19:00 |

Zambezi River Optional Cruise (suggested activity offered by the Zambezi Explorer)

|

| Time | Session Details |

|---|---|

08:30 - 09:10 |

Plenary Session - Moshe Milevsky Topic: Longevity Risk Pooling: A Short History Chair: Colin Ramsay

|

09:10 - 10:30 |

Contributed Talk Parallel Session 3.1 Chair: Andres Villegas Location: Room 1 09:10 Stephane Loisel - Quickest detection of changes in longevity patterns 09:50 Tolulope Fadina - Optimal reinsurance under model uncertainty

Contributed Talk Parallel Session 3.2 Optimisation Chair: Karim Barigou Location: Room 2 09:50 Delfim Torres - A Stochastic Capital-Labour Model

Contributed Talk Parallel Session 3.3 Post Retirement Chair: Jed Frees Location: Room 3 09:10 Annamaria Olivieri - Disclosing the Reserving Process in Life Insurance Through Periodic Fees 09:50 Colin Ramsay - Exploring the Impact of Quality of Care in a Multi-State Long Term Care Model 10:10 Kristina Sendova - A case study on how prepared Canadians are for retirement

|

10:30 - 11:00 |

Society of Actuaries Sponsored Coffee Break

|

| 11:00 - 13:00 |

Parallel Session W1.1 - Teaching Session on Beyond the Horizon: Exploring the Challenges and Opportunities in Actuarial Education for Future Success. Location: Room 1 11:00 - 11:05 Introductory Overview of the Session - Kevin Liu 11:05 - 12:00 Panel Discussion 1: Current Challenges in Actuarial Education Local Representative - Lynette Tasaranarwo ( National Social Security Authority of Zimbabwe (NSSA) and the University of Zimbabwe) Local Representative - Gift Muchatibaya (University of Zimbabwe) Association Representative - Michael Tichareva (Actuarial Association of South Africa) International Representative - Xiao Xu (UNSW Sydney and Society of Actuaries ) International Representative - Diana Skrzydlo (University of Waterloo 12:00 - 13:00 Education Showcase (60mins - 12 mins presentation x5) 12:00 Diana Skrzydlo - Aligning Assessment for Aspiring Actuaries 12:12 Kevin Liu - StoryWall: A Formative Assessment Model for Empowering Students as Partners in Learning 12:36 Xiao Xu - The ‘real-world’ solutions students learned from SOA Research Challenge 12:48 Poon Leung - Designing Data Storytelling

Parallel Session W1.2 - PhD Forum Chair: Xavier Milhaud Location: Room 2 Presentation: The Role of Direct Capital Cash Transfers Towards Poverty and Extreme Poverty Alleviation - An Omega Risk Process 11:00 Eugene Msizi Buthelezi - Impact of Fiscal Consolidation on Domestic Government Debt in South Africa 1979 - 2022 11:40 Zabibu Afazali - Dependence modeling in non-life insurance using Local Gaussian Correlations 12:00 Yves-Cédric Bauwelinckx - On the causality-preservation capabilities of generative modelling 12:20 Video on University of Toronto

Parallel Session W1.3 - PhD Forum Chair: Tolulope Fadina Location: Room 3 11:00 Paulina Nangolo - Optimal Portfolio Selection of a Constant Proportion Portfolio Insurance when Asset follows Hawkes-Jump-Diffusion. 11:20 Rhoda Dzadzie-Dennis - Portfolio Optimization under Climate Change 11:40 Mwizere Rene - Long-term Sustainable Investment for Retirement 12:00 Alexis Levendis - Static Hedging of Non-Exchange Traded Options in South Africa

|

| 13:00 - 14:00 |

Lunch

|

| 14:00 - 15:20 |

Parallel Session W2.1 - Teaching Session on Beyond the Horizon: Exploring the Challenges and Opportunities in Actuarial Education for Future Success. Location: Room 1 14:00 - 15:00 Panel Discussion 2: Preparing the Next Generation of Actuaries 15:00 - 15:20 Launch of the Africa Actuarial Educators and Researchers Network

Parallel Session W2.2 - PhD Forum Chair: Ayse Arik Location: Room 2 14:00 Oriol Zamora Font - Change of measure in a Heston-Hawkes stochastic volatility model 14:20 Rodrigue Kazzi - Assessing tail risk for unimodal right-skewed distributions 14:40 Video on University of Toronto

|

| 15:20 - 15:40 |

CAS Sponsored Coffee Break

|

| 15:40 - 17:00 |

Panel Discussion: Global Perspectives on Risk Based Capital Implementation Chair: Tinashe Mashoko

|

| 17:00 | Marc Henry |

| 18:00 - 22:00 |

Traditional GALA Dinner at the BOMA

|

| Time | Session Details |

|---|---|

08:30 - 09:10 |

Plenary Session - Blessing Mudavanhu Topic: A discounted cashflow approach to loan loss provisioning Chair: Mary Hardy

|

09:10 - 10:30 |

Contributed Talk Parallel Session 5.2 Chair: Annamaria Olivieri Location: Room 1 09:10 Elvira Sojli - Time-varying Group Unobserved Heterogeneity 09:50 Ruediger Kiesel - Prolegomenon for Managing Climate Risk 10:30 Noreen Watyoka - Climate change adaption strategies in influencing the inclusion of natural disruptions insurance in Zimbabwe

Contributed Talk Parallel Session 5.3 Variable Annuities Chair: Etienne Marceau Location: Room 2 09:10 Franck Adekambi - An analysis of the value of equity-linked death benefits based on the exponential Levy process 09:30 Jonathan Ziveyi - Innovative Combo Product Design Embedding Variable Annuity and Long-term Care Insurance Contracts 09:50 Yang Miao - Analyzing retirement preparedness: a study of a Canadian investment data set 10:10 Rob Rusconi - The Contribution of Insurers to Systemic Risk: A practical

|

10:30 - 11:00 |

Society of Actuaries Sponsored Coffee Break

|

| 11:00 - 12:20 |

Panel Discussion: Climate Risks & Sustainability - Simba Takawira Chair: Marvelous Dumba Title: "Climate Change and the Transition to a Low Carbon Economy: Is the Financial Services Sector in Africa Doing Enough?"

|

| 12:20 - 13:00 |

Sponsored Session: Actuarial Applications to Banking and Insurance Michael Tichareva - Opportunities for Applying Actuarial Techniques in Banking Chair: Xiao Xu

|

| 13:00 - 14:00 |

Lunch

|

| 14:00 - 17:00 |

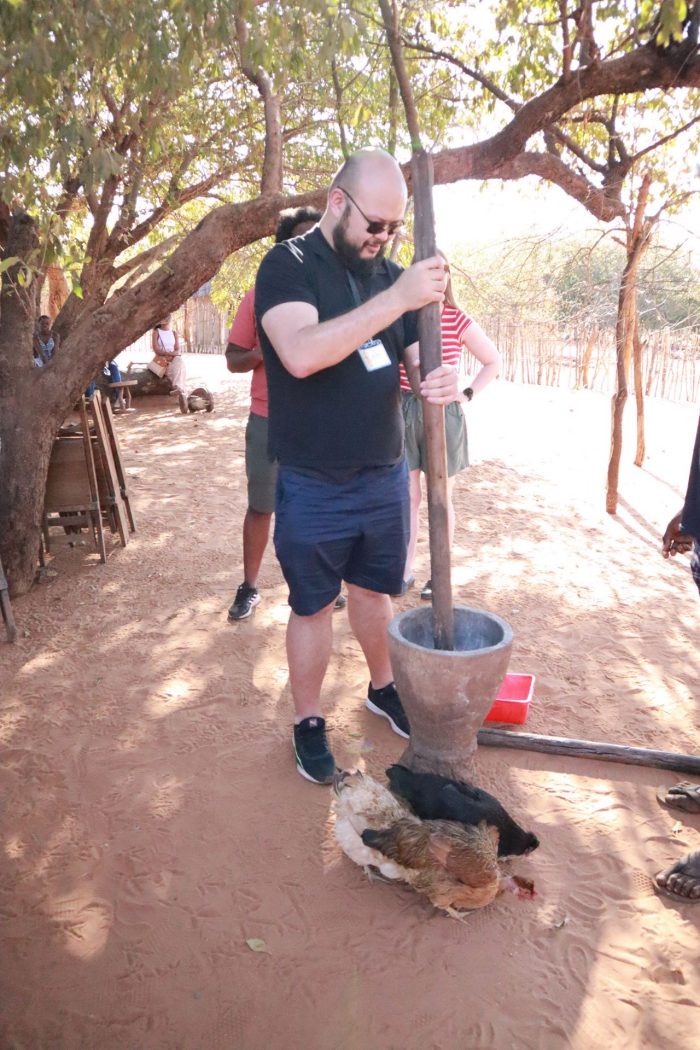

Village Tour / Conference excursion

|

| Time | Session Details |

|---|---|

08:30 - 09:30 |

Fireside Chat with John Robinson Chair: Roy Machamire and Lynette Tasaranarwo

|

09:40 - 10:40 |

Contributed Talk Parallel Session 6.1 Health and Retirement Financing Chair: Doreen Kabuche Location: Room 1 09:40 Annika Krutto - How accurate and reliable is miRNA testing in predicting disease risk and how can it be best integrated into health and life insurance decision-making? A heavy-tailed perspective. 10:00 Blessing Mbukude - Regulating for the Millennial Pensioner

|

| 09:40 - 10:40 |

Contributed Talk Parallel Session 6.2 Risk Modelling Chair: Roudu Wang Location: Room 2 9:40 Idelia Hoberg - Actuarial Society of South Arica South African Sovereign Credit Risk Working Group Paper 10:00 Etienne Marceau - Collective risk models with FGM dependence

|

10:40 - 11:00 |

Society of Actuaries Sponsored Coffee Break

|

| 11:00 - 11:40 |

Plenary Session - Roseanne Harris - The actuarial role in promoting universal health coverage Chair: Lynette Tasaranarwo

|

| 11:40 - 12:50 |

Panel Discussion: Social Security and Healthcare Title: Exploring Alternative Financing Mechanisms for National Health Insurance in Africa Chair: Tawanda Chituku

|

| 12:50 - 13:00 |

Conference Closing and vote of thanks and reflection + next AFRIC

|

| 13:00 - 14:00 |

Lunch

|

Awards for best PhD Student Presenters

AFRIC will run a dedicated session for doctoral students with each accepted submission assigned a discussant who is a subject matter expert. PhD students who submit complete or close to complete working papers will be considered for best paper awards, thanks to AFRIC sponsor, KU Leuven, who have provided financial support for this initiative. The Doctoral student session is aimed at increasing networking opportunities for early career researchers with experts within their research domain. Doctoral students are highly encouraged to submit either complete/ semi-complete working papers, abstracts or research proposals for their research agenda.

Eligibility

The prize is open only to Doctoral students who will be attending and presenting at AFRIC in Victoria Falls. To be eligible, one must be currently enrolled at any recognised university.

Entry Requirements

- A complete paper submission accepted into the AFRIC program will automatically be considered for the best paper awards.

- The paper must not have been published previously or have been accepted for publication.

Criteria

Quality, in terms of

- Originality

- Significant contribution to literature

- Well-written.

Prizes

The Doctoral Session will be chaired by a judging panel consisting of seasoned academics who will rank all submissions and the corresponding presentations. Three prizes will be awarded as follows:

- The best paper award - €500.

- First runner up - €300.

- Second runner up – €200.

Accommodation and Activities

We have negotiated an accommodation rate with Elephant Hills hotel at US$130 per night bed and breakfast (US$160 for a double room) over the duration of the conference. Reservations are limited and you are encouraged to RSVP early. For accommodation reservations, please contact Elephant Hills Hotel directly with the discount code “AFRIC 2023” on bqmgr@ehr.africansun.co.zw. The email must be addressed to the Assistant Banqueting Manager, Ms. Eunice Zemba.

Victoria Falls is rich in nature and cultural activities. Information on self-funded excursions and activities can be found here.

Contact Sun Leisure for updated costs and dates - sunleisurereservations@africansunhotels.com

Programs

Confirmed dates: 23rd - 28th of July 2023

- Welcome reception and registration on the 23rd of July

- Pre-conference practitioner inclined workshop on the 24th of July – full day data analytics / machine learning 1st part focusing on theory and then the second part on applications to various business lines.

- PhD Forum - Wednesday 26 July.

- Conference talks to run from the Tuesday the 25th – Friday the 28th of July.

- Conference delegates are invited to register for the famous Boma Dinner through the conference registration page.

- There will be a traditional village tour excursion which will take you through a typical day to day like in the village from meal preparations to chores around the homesteads.

- Other key highlights include the majestic Victoria Falls (Mosi-oa-Tunya), day and night game drives, bungy jumping, elephant encounters, among others

Committee/ Speakers

- Scientific committee

- Organising committee

- Jennifer Alonso-Garcia – Universite Libre de Bruxelles, Belgium

- Eric Cheung – UNSW Sydney, Australia

- Pierre Devolder, UCLouvain, Belgium

- Ka Chun Cheung, The University of Hong Kong

- Jan Dhaene – KU Leuven, Belgium

- Munir Haibu – University of Copenhagen, Denmark

- Hamza Hanbali – University of Monash, Australia

- Katja Hanewald – UNSW Sydney, Australia

- David Landriault, University of Waterloo, Canada

- Stephane Loisel – Universite Lyon 1, France

- Anne MacKay, Universite de Sherbrooke, Canada

- Sure Mataramvura – University of Cape Town, South Africa

- Xavier Milhaud – Aix-Marseille University, France

- Gift Muchatibaya – University of Zimbabwe, Zimbabwe

- Annamaria Olivieri – University of Parma, Italy

- Jerry Parwada, UNSW Sydney, Australia

- Colin Ramsay, University of Nebraska-Lincoln, United States of America

- Ronald Richman, Old Mutual, South Africa

- Kristina Sendova, Western University, Canada

- Yang Shen – UNSW Sydney, Australia

- Michael Sherris – UNSW Sydney, Australia

- Julien Trufin – Universite Libre de Bruxelles, Belgium

- Andres Villegas – UNSW Sydney, Australia

- Bernard Wong – UNSW Sydney, Australia

- Mengyi Xu, Purdue University, United States of America

- Jonathan Ziveyi – UNSW Sydney, Australia

- Yi Lu – Simon Fraser University, Canada

Chair:

- Gift Muchatibaya (Co-Chair, local) – University of Zimbabwe, Zimbabwe

- Jonathan Ziveyi (Co-Chair) – UNSW Sydney, Australia

- Blessing Mudavanhu (Co-Chair) – Commercial Bank of Zimbabwe

- Mike Tichareva (Co-Chair, Industry Engagement) – National Standard Finance Africa

Members:

- Maree Withers, UNSW Sydney, Australia

- Lexie Irvine, UNSW Sydney Australia

- Jennifer Alonso-Garcia – Universite Libre de Bruxelles, Belgium

- Jan Dhaene – KU Leuven, Belgium

- Munir Haibu – University of Copenhagen, Denmark

- Hamza Hanbali – University of Monash, Australia

- Salvatory Kessy – UNSW Sydney, Australia

- Martin Le Doux Mbele Bidima, University of Yaounde 1, Cameroon

- Sure Mataramvura – University of Cape Town, South Africa

- Lynette Nyaradzai Tasaranarwo, National Social Security Authority, Zimbabwe

- Chessman Wekwete- Hanover Re, Sydney Australia

- Andres Villegas– UNSW Sydney, Australia

- Simba Takawira – Nedbank, South Africa

- Jerry Parwada – UNSW Sydney, Australia

Venue

Elephant Hills Hotel - Victoria

- The organisers have negotiated a special conference rate of US$130 per night (bed and breakfast) with Elephant Hills Hotel for the duration of the conference. Reservations are limited and you are encouraged to RSVP early. We will be providing a reservation code shortly.

- The conference organisers will make arrangement for airport transfers with Elephant Hills Hotel. Full details will be provided shortly.

- Other accommodation options in Victoria Falls are as follows:

- The Victoria Falls Hotel -

- A’Zambezi River Lodge -

Travelling to Victoria Falls

- A number of airlines have connecting flights to Victoria Falls International Airport such as British Airways, Ethiopian Airlines and Emirates. You are encouraged to book your flights in advance as the conference time coincides with a peak season in Victoria Falls with high volumes of tourists visiting the resort.

- Things to do in Victoria Falls, see here.

Zimbabwe Visa Requirements

- As for the travel requirements, visit this page to view all the visa requirements including the fees.

- If you are a Category A passport holder, you won’t need a visa to enter Zimbabwe. For Category B passport holders, I strongly suggest that you apply for the visa at the “port”, that is, upon arrival in Victoria Falls (or any other port of entry). Try not to apply online as this may cause unnecessary delays upon arrival with the officials having to go through a “manual” processing of checking your electronic visa.

- If you are a Category C passport holder, you will need to apply for the visa beforehand and I would recommend getting in touch with a Zimbabwe High Commission in your home country or neighbouring country.

- As for Covid requirements, a vaccination certificate is required or proof of negative COVID-19 (PCR) test conducted within 48 hours of travel. This must be from an approved laboratory through the Trusted Travel platform

Sponsors

Platinum Sponsors

Commercial Bank of Zimbabwe (CBZ) Holdings Limited

School of Risk and Actuarial Studies, UNSW Sydney

Gold Sponsors

IFID Centre

AFIR | International Actuarial Association

Silver Sponsors

Department of Econometrics and Business Statistics, Monash University

Claxon Actuaries International

University of Zimbabwe

Bronze Sponsors

Society of Actuaries

Institute and Faculty of Actuaries

ASTIN | International Actuarial Association

Old Mutual Insure

CAS | Casualty Actuarial Society

The Institute of Actuaries in Belgium (IA|BE)

MFI | University of Toronto

ZAC Global

PhD Forum and Best Paper Gifts

Katholleke Universiteit Leuven